The center on budget and policy priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It helps to track the big financial institutions through the trades they make. | sierra chart footprint | depth of market. Web the three most common types of order flow charts are total volume order flow, bid x ask order flow (footprint), and delta order flow. Order flow trading is a strategy that offers traders an edge by providing valuable market insights.

Order flow trading is a strategy that offers traders an edge by providing valuable market insights. Tools like the order book, market depth, and volume profiling are used to conduct order flow analysis. Let’s take a look at the main ones and how they can be used. Trading platforms like ninjatrader provide key features for implementing order flow trading strategies. Identifying buying and selling pressure, unveiling market sentiment.

It gives details like trade direction, price movement, and volume, whose combination gives a complete picture of the security momentum and trend. Analyzing the order flow helps you recognize the final details of the buying and selling volume. It requires predicting fellow traders’ moves. It helps traders understand the sentiment behind the market moves and make. Web the three most common types of order flow charts are total volume order flow, bid x ask order flow (footprint), and delta order flow.

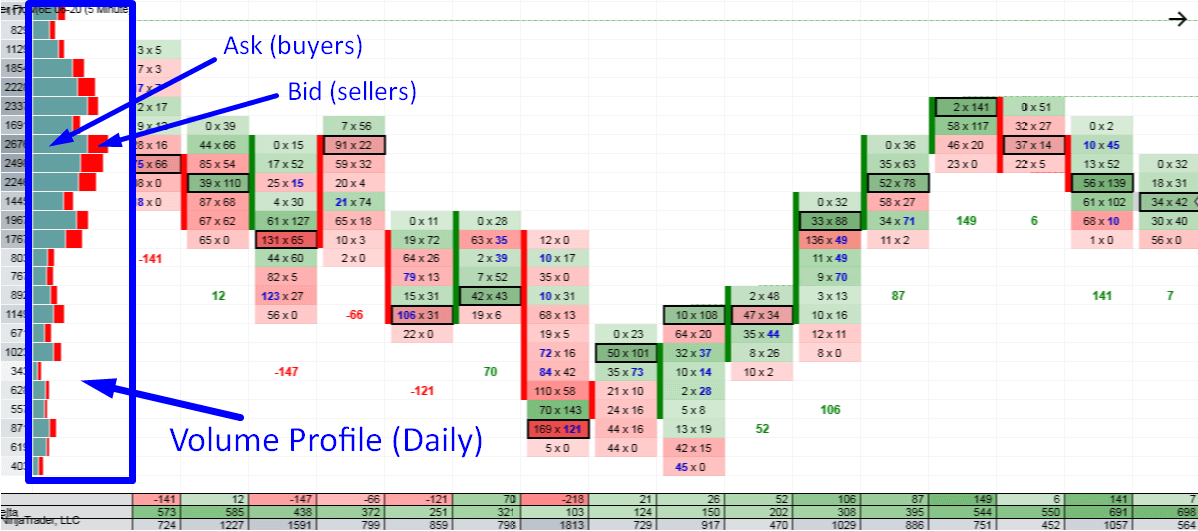

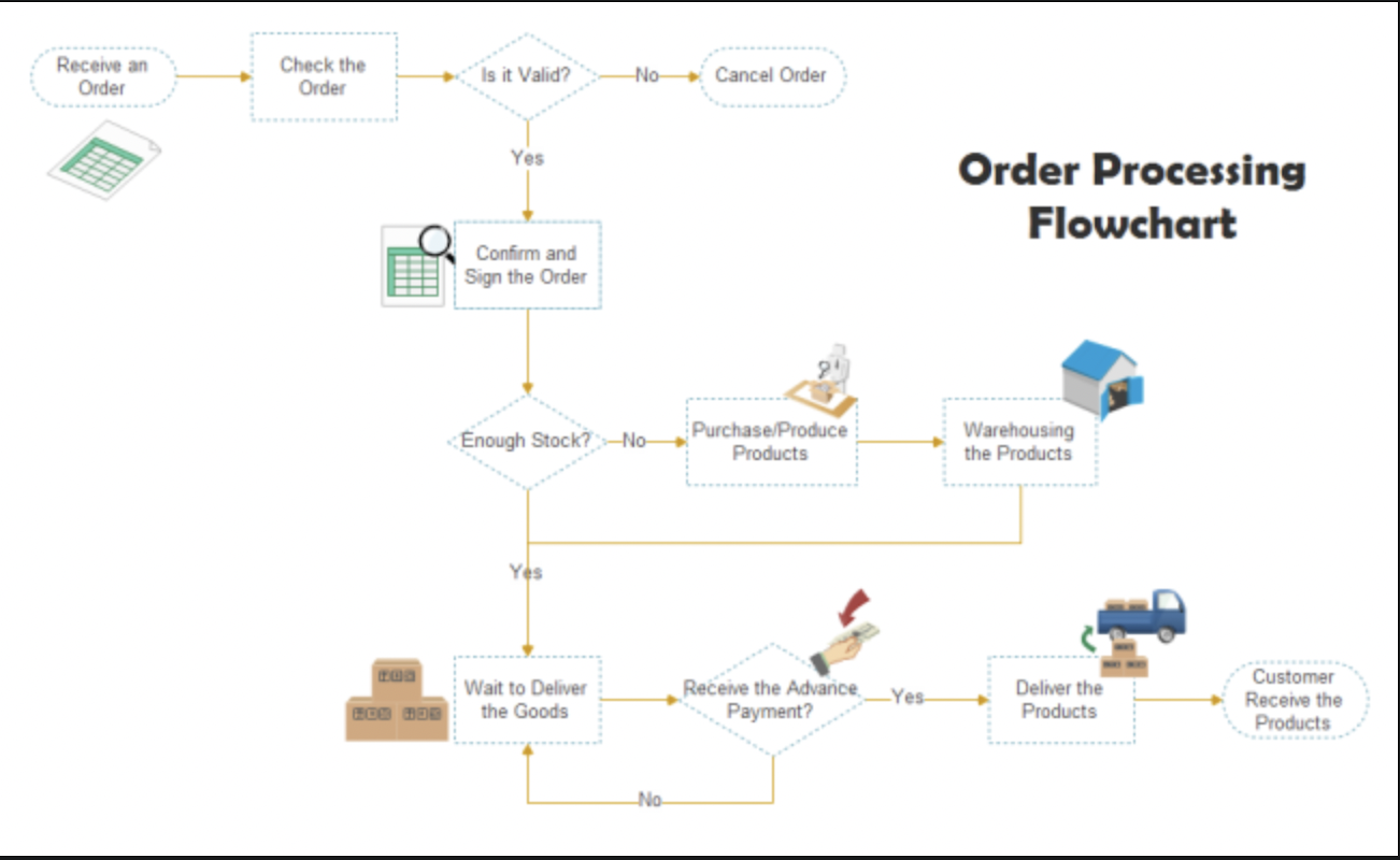

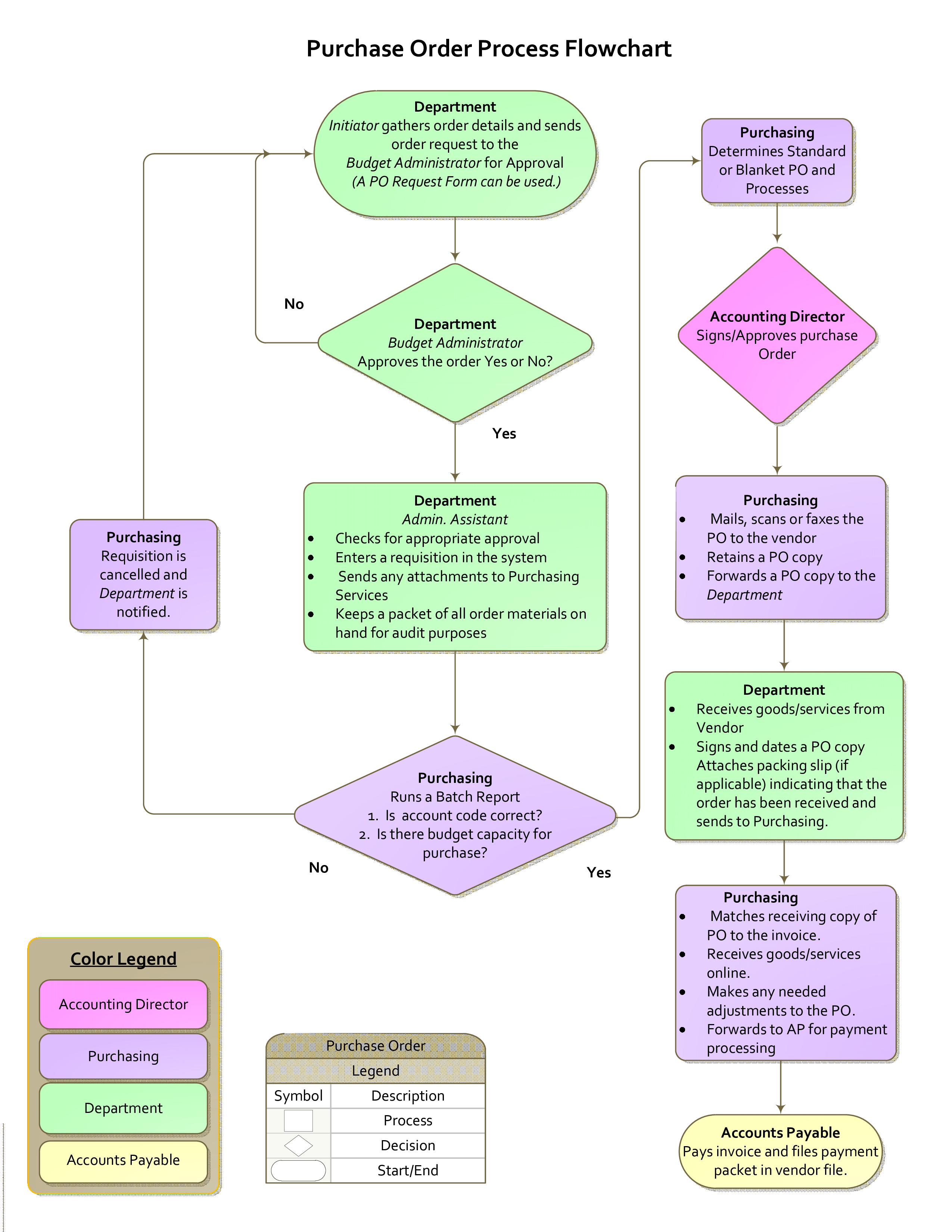

The bid/ask footprint chart above displays all of market orders that traded on the bid and the ask for every price level. Web orderflow charts can show you in real time the actual demand and supply at the exchange by simulating the transactions occurring at the exchange on your chart. Most people get confused when they open up a chart with order flow for the first time. Tools like the order book, market depth, and volume profiling are used to conduct order flow analysis. Web order flow trading involves analyzing the orders entering the market to gain insights into supply and demand. This method allows traders to identify key levels and discern strong support and resistance locations. It’s a microscopic look into the price movement that is represented on the price bar or candlestick. Ms office exportimport & export visioavailable online & offfree support Web a jigsaw dom is one of the most popular dom traders use and jigsaw webinars presented by peter davies are one of the best resources for learning orderflow trading. The center on budget and policy priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. Web federal budget, federal tax. It gives a deeper insight into the supply and demand dynamics, showing us not just where the price is, but where it might head next. Web the three most common types of order flow charts are total volume order flow, bid x ask order flow (footprint), and delta order flow. Order flow is an advanced charting software which enables you to read all trading orders that are processed in the market. Intuitivesecure & reliablechat support availablehundreds of templates

There Is No Shame In That.

Intuitivesecure & reliablechat support availablehundreds of templates Advanced featureshundreds of sample appsdownload free evaluationtake the tutorial Web order flow is very important in trading as it provides very meaningful insights into the supply and demand market. At its core, the indicator analyzes order flow, distinguishing between bullish and bearish volume within a specified period.

Web Order Flow Definition:

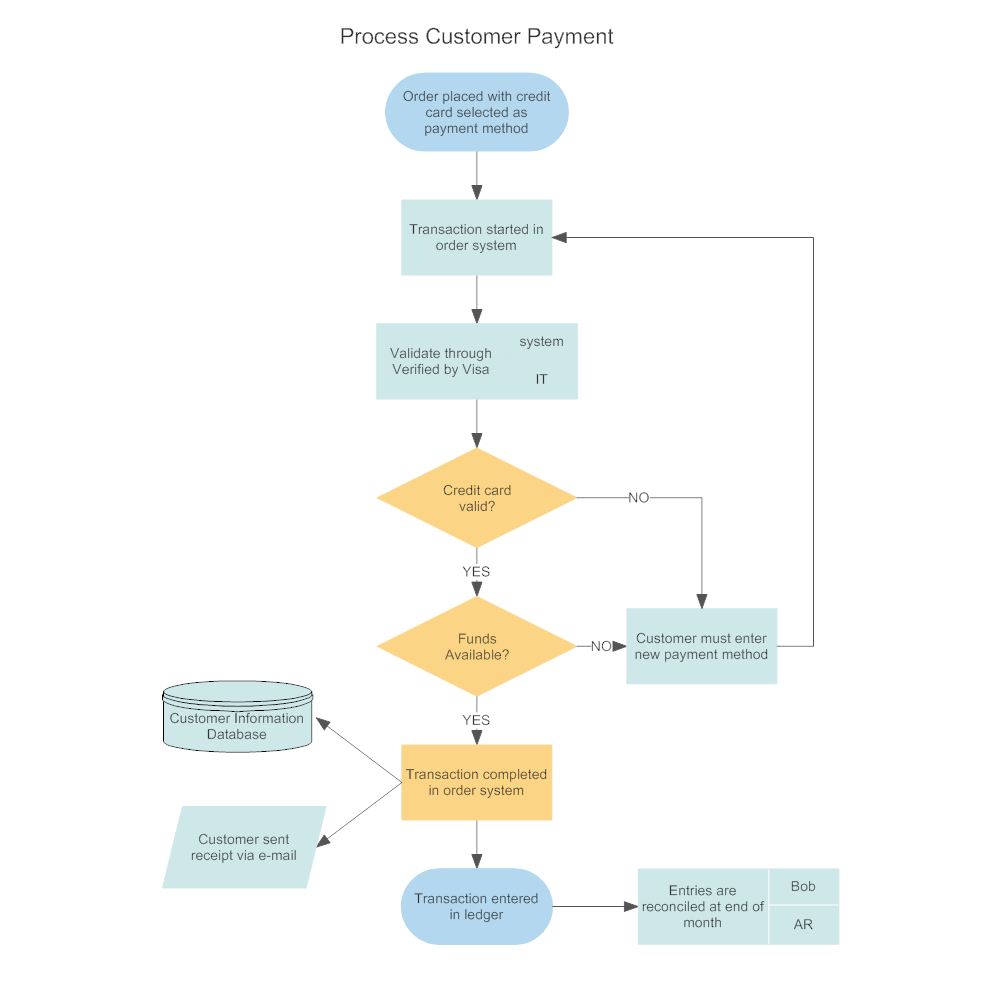

You can then begin analyzing this data using price action and market depth analysis to identify potential trade setups. Web order flow trading represents a pivotal strategy in the financial markets, allowing traders to anticipate market movements by analyzing the flow of buy and sell orders. Web order flow trading is a type of short term trading strategy as it is used to enter the market accurately based on recent executed buy and sell orders. Besides that, they recently released the daytradr platform which includes all things such as market profile, candlestick charts, and footprint charts.

Traders Can Witness Transactions As They Occur, Gaining Insights Into Market Dynamics.

It helps to track the big financial institutions through the trades they make. The bid/ask footprint chart above displays all of market orders that traded on the bid and the ask for every price level. Analyzing the order flow helps you recognize the final details of the buying and selling volume. Web a jigsaw dom is one of the most popular dom traders use and jigsaw webinars presented by peter davies are one of the best resources for learning orderflow trading.

Web Advanced Order Flow Trading Charts & Education | Often Duplicated, Never Replicated.

This method allows traders to identify key levels and discern strong support and resistance locations. Web order flow trading involves analyzing the orders entering the market to gain insights into supply and demand. Ppt templatesunlimited downloadsfree lifetime updatesbest ppt templates Most people get confused when they open up a chart with order flow for the first time.