Web to help demystify the sprawling world of modern credit scores and their effects on your ability to borrow money and fund mortgages, let’s take a deeper look at credit score ranges, what they mean for you, and how to ensure you’re doing all you can to create sound financial habits. What affects your credit scores? How to improve your credit scores. How are credit scores calculated? Again, each lender has its own credit risk standards, but this chart will give you a sense of what a fico score in a particular range means.

The score is based on six main categories related to credit use. Web the fico model of credit scoring puts credit scores into six categories: How are credit scores calculated? Why having a good credit score is important. Of course both your positive and negative credit history is considered.

Check your credit when daylight savings time begins and ends! It is supported primarily by foundation grants. Of course both your positive and negative credit history is considered. Understanding the factors that affect your credit score can help you to take steps to improve your score over time. Some people want to achieve a score of 850, the highest credit score possible.

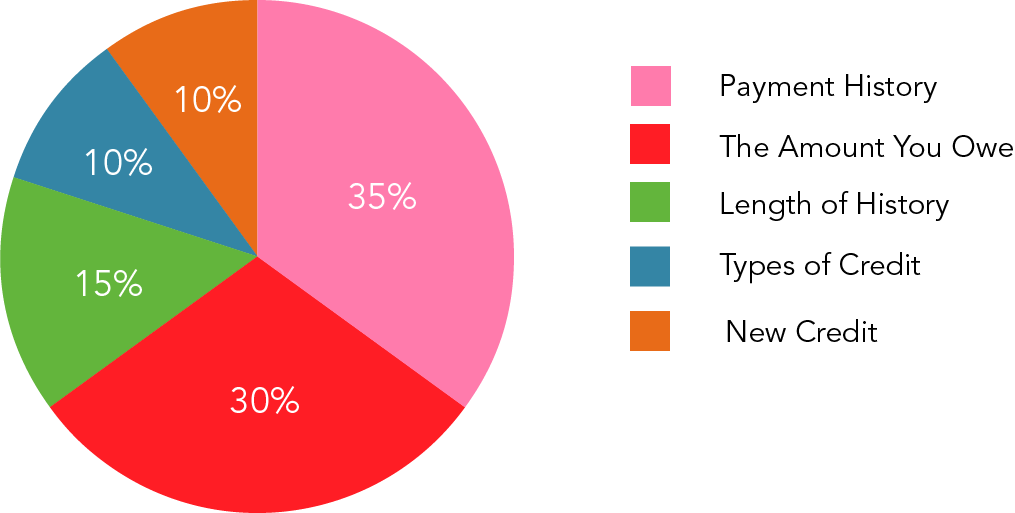

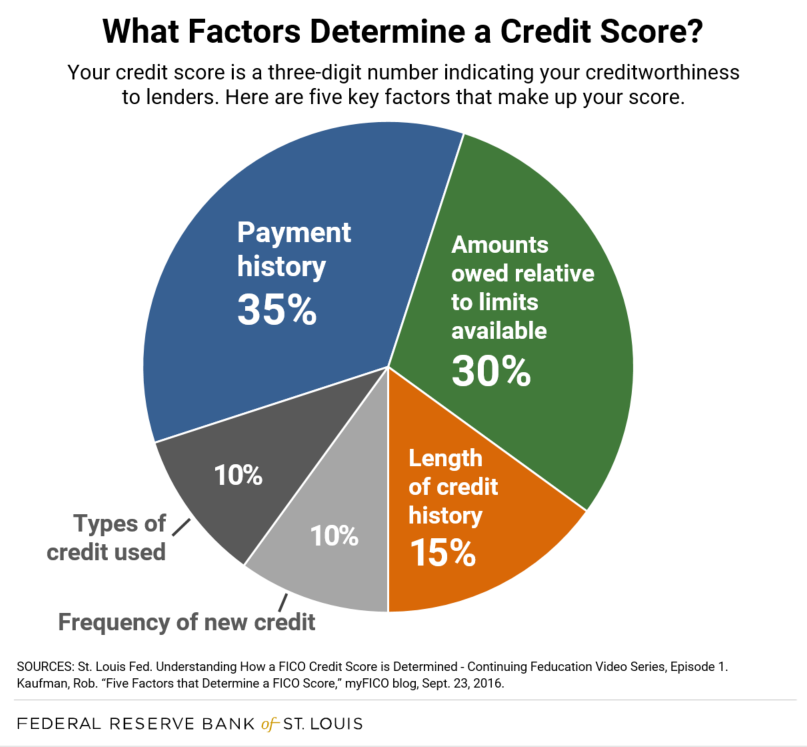

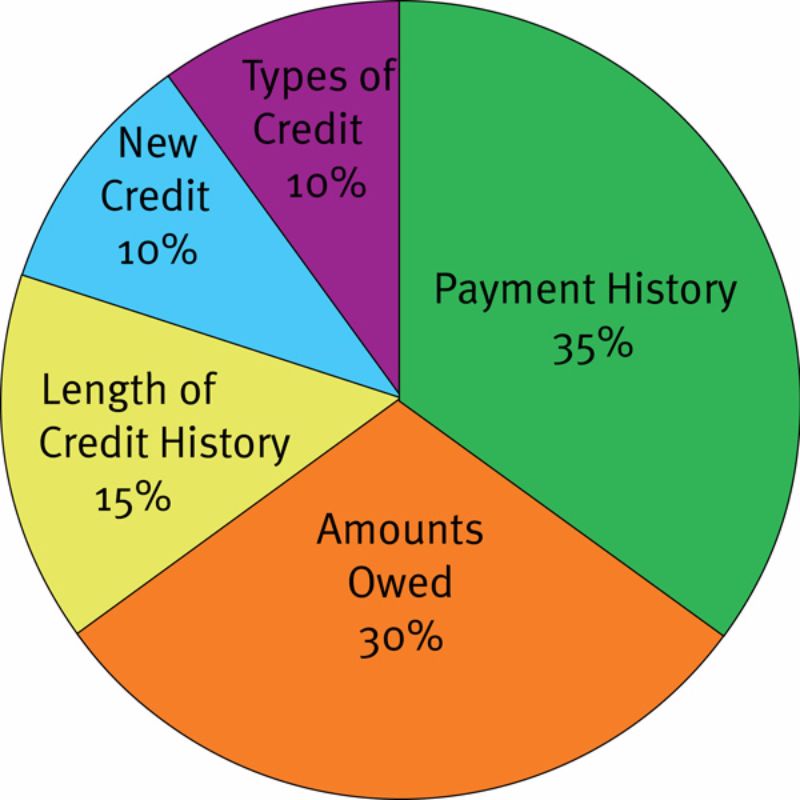

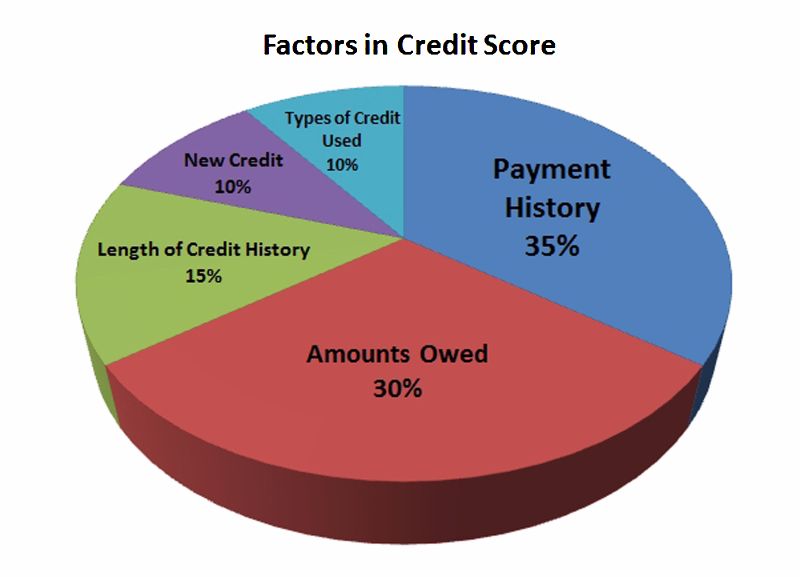

Payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). The american economy has held up well against higher inflation and interest rates. When you get a credit score from transunion, it’s a vantagescore® 3.0 credit score. The two most prominent credit scores are from fico and vantagescore. Web a pie chart is often used to explain factors that impact a fico score. Payment history, amounts owed, length of credit history, new credit, and credit mix. Web to help demystify the sprawling world of modern credit scores and their effects on your ability to borrow money and fund mortgages, let’s take a deeper look at credit score ranges, what they mean for you, and how to ensure you’re doing all you can to create sound financial habits. 35% amounts you owe (your credit utilization ratio): Rent, utilities, groceries, transportation, insurance, and healthcare. Understanding the factors that affect your credit score can help you to take steps to improve your score over time. What is a good fico score? How to improve your credit scores. Understanding how they work can help you improve your credit history, qualify for lower interest rates on loans and more. The charts below show what factors make up two popular credit score models, the fico® score 8 credit score and vantagescore 3.0® credit score models. The center on budget and policy priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs.

Having A Low Ratio—In Other Words, Not Much Debt But A Lot Of Available Credit Is Good For Your Credit Score.

Payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). Web fico scores are calculated using many different pieces of credit data in your credit report. Check your credit when daylight savings time begins and ends! Web the fico model of credit scoring puts credit scores into six categories:

Payment History And Amounts Owed Weigh The Heaviest In The Categories That Determine Your Fico Score.

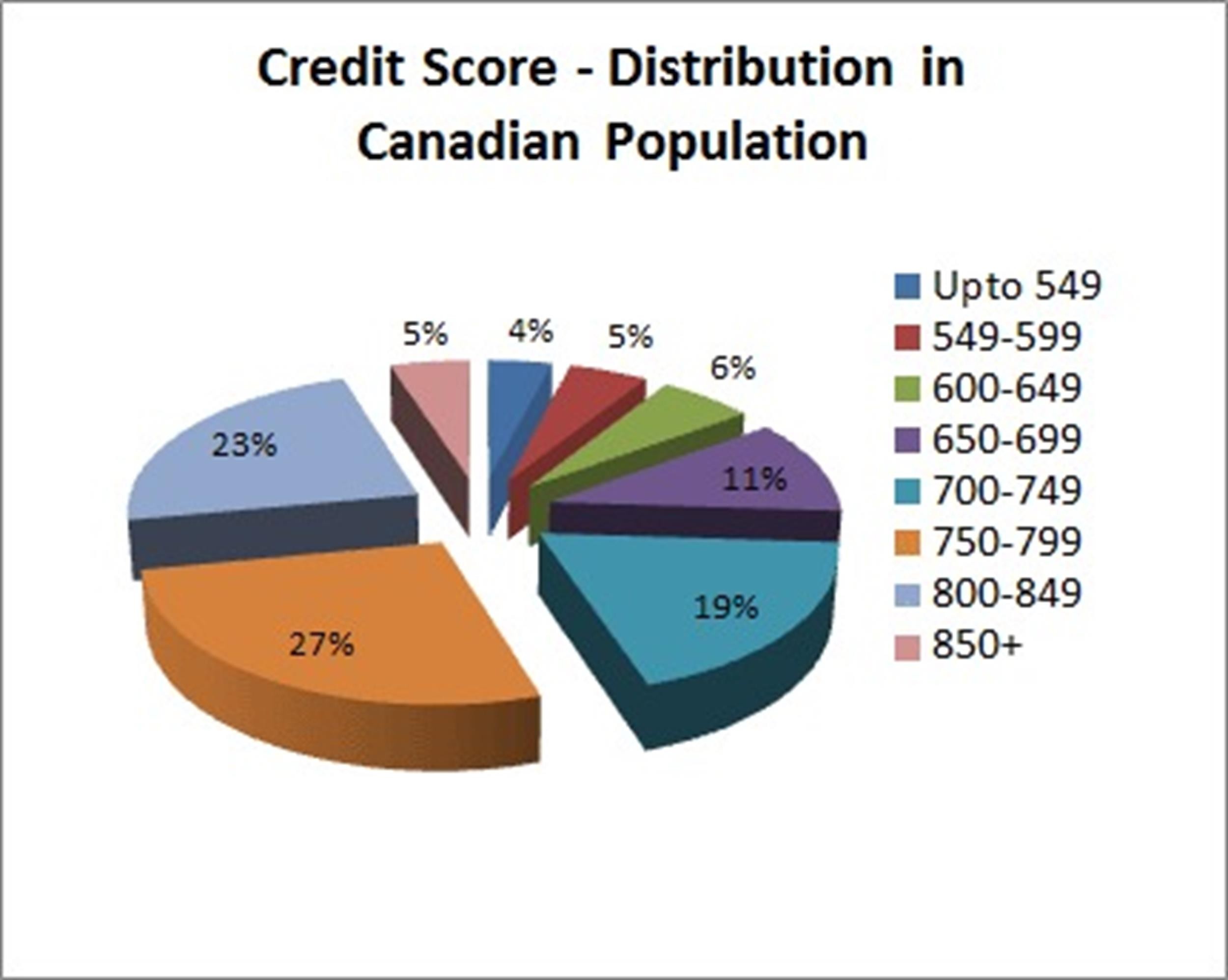

Both have different versions of their scoring models. Each piece is allocated a percent of the pie. Web for a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. Again, each lender has its own credit risk standards, but this chart will give you a sense of what a fico score in a particular range means.

Below Is A Breakdown Of The Vantagescore 3.0 Credit Score Factors.

**a credit inquiry is created when a. Find out these elements with its percentage weightage in this simplified explanation by forbes advisor. Web here’s a chart that breaks down the ranges of fico ® scores found across the us consumer population. How to improve your credit scores.

This Data Is Grouped Into Five Categories:

Why having a good credit score is important. Credit scores are a numerical expression of your creditworthiness and how you've managed credit and debt. It's the core of our budget, filling and necessary. Web your credit scores are determined by credit scoring models that analyze one of your consumer credit reports and then assign a score (often ranging from 300 to 850) using complex calculations.